Product request

You are looking for a solution:

Select an option, and we will develop the best offer

for you

Android TV: The Era Of Open Platforms

Can a local IPTV/OTT operator build an internationally recognised service? How can they compete with giants who invest millions of dollars in development? Android TV™ can help.

Android TV is an open platform with built-in Google services. This is an operating system for premium set-top boxes and smart TVs. The solution is being improved but will remain free.

Android TV history

In 2010, Google Inc., in conjunction with Intel, Sony, and Logitech, released Google TV, an interactive platform for smart TV. This solution ran Android OS with an integrated Chrome browser. In 2014, its Android 5.0 Lollipop-operating successor, Android TV, appeared. Nexus Player, created by Google in partnership with Asus, became the first device operating on the new platform. In May 2015, the Nvidia Shield set-top box was released.

With the advent of Android TV 6.0, more and more manufacturers began to produce set-top boxes and smart TVs based on the new OS. Android TV 6.0 offered out-of-the-box voice control, built-in PVR and PiP (picture in picture) functions, as well as an elaborate Leanback library that allowed operators to change the user interface.

Channel API and the TIF framework allowed developers to display content from apps directly on the Android TV start screen. Users were able to search for content in all of their apps at once.

Android TV: statistics and prospects

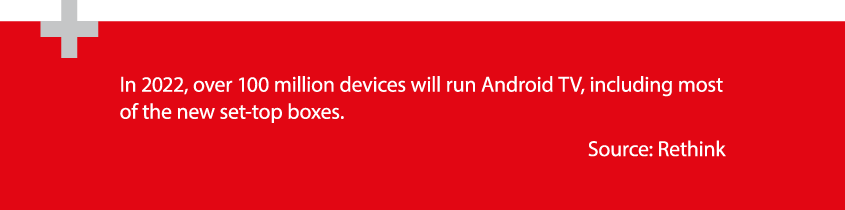

More than half a million Android TV devices are sold every month. According to the S&P Global Market Intelligence forecast, more than 40.1 million devices will be sold in 2021, 27 million of which will be smart TVs and 11.9 million of which will be set-top boxes.

Prospects for Android TV involve smart TVs as well. According to Strategy Analytics, in 2018, 157 million smart TVs were sold, and every tenth unit ran Android TV. The platform’s main competitor is Tizen OS from Samsung: it occupies 20% of the market (with 32 million devices sold in 2018). If we consider the sales of AOSP-operating smart TVs, we can see that the market leader is Android.

Differences between the Android TV, AOSP, and Android TV Operator Tier

|

|

|

|

|

|

Android TV devices are available in retail stores. Android TV set-top boxes and TVs are not dependent on the operator and can operate on any network.

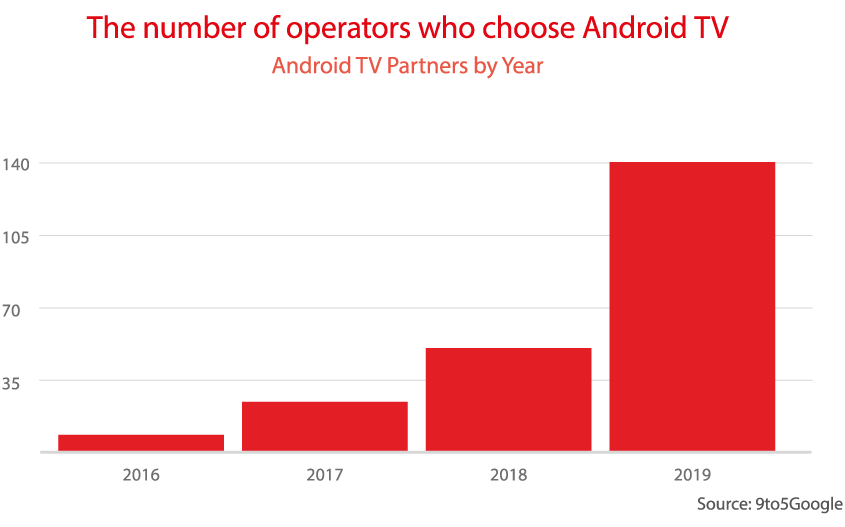

Google reported at the Connected TV World Summit in London that by March 2019, Android TV would be used by 140 IPTV/OTT operators. This number has increased by more than seventeen times in the past three years.

Operator Tier is a fast and cost-effective way to enter the market, but Google does not offer turnkey solutions.

|

|

Advantages of Android TV

| |

| |

|

| |

| |

|

Is Google in control?

Operators fully control their own set-top boxes and smart TVs. However, Google sets some requirements, for example, mandatory updates every ninety days.

The corporation collects only data to display as customised ads. IPTV/OTT service statistics and viewers' personal data are secure. Users can install apps that collect more data, but neither Google nor the operator can influence this.

| One of Android TV’s security measures is Widevine DRM support. The system encrypts the content so that only an authorised user can play it. The solution supports more than a billion devices: smart TVs, set-top boxes, smartphones, game consoles, and tablets. To minimise the risk of piracy and cyberattacks, some operators integrate third-party security systems into Android TV. |

The battle for HDMI 1

Android TV does not restrict access to Google Play. For this reason, the Android system remains free—Google makes money on an ecosystem of apps. Some companies choose AOSP, where the app store is under their complete control.

Operators who have chosen Android TV have accepted the viewer’s freedom. By allowing the installation of competing apps, the service provider retains control over the HDMI 1 port and the main place in the search results. To subscribe to Netflix, the viewer doesn’t need a third-party device capable of supplanting the operator’s device in the future.

The era of open platforms

IPTV/OTT operators may abandon proprietary solutions in favour of open platforms in the coming decade. Companies will rely on Android TV or similar solutions, such as RDC from Comcast or Frog from the French company WyPlay. At the same time, set-top boxes with proprietary operating systems will dominate in undeveloped markets, where reliable broadband connections are not available to viewers.

With Android TV, local IPTV/OTT operators build premium-level services and compete with companies that invest millions of dollars into research and development. Larger operators also appreciate the system’s advantages are because in an international battle for viewers' attention, they need platforms with great potential. One of them is Android TV.

*Google, Android, Google Play, Android TV and other marks are trademarks of Google LLC.

Recommended

IPTV and E-commerce: Prospects of Built-in Online Stores on the TV Screen

Over the past few years, IPTV platforms have gone beyond being merely a channel for delivering television content.

How to Properly Organize Backup Servers for IPTV Streams

The IPTV and OTT market is growing rapidly, with the quality of broadcasts continuing to improve, the number of channels increasing, and the functionality of set-top boxes and applications expanding.

The Evolution of Codecs: From H.264 to AV1 and VVC — What Should Operators Choose?

Over the past decade, the video market has undergone a rapid shift from linear TV to flexible IPTV/OTT services, where image quality and delivery efficiency play a crucial role.